Banks and Building Societies. General Requirements

The requirements for the construction of a bank vary and depend on the nature of the bank's business (e.g. a high street bank with a large number of customers or an institution that handles large-scale investments and corporate work). In general the function of a high street bank is to allow money, whether in cash or some other form, to be paid in and withdrawn. Procedures must be transacted as quickly, securely and simply as possible.

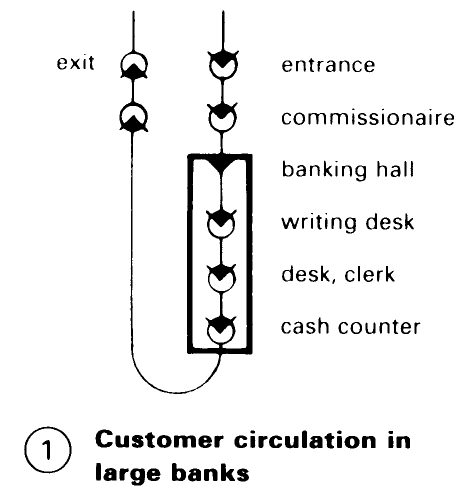

Customers enter from the street outside, and then pass through a lobby, if appropriate, into the banking hall. The latter is often fitted with bench seats or chairs for waiting customers and small writing desks for customers, and has various positions for conducting transactions.

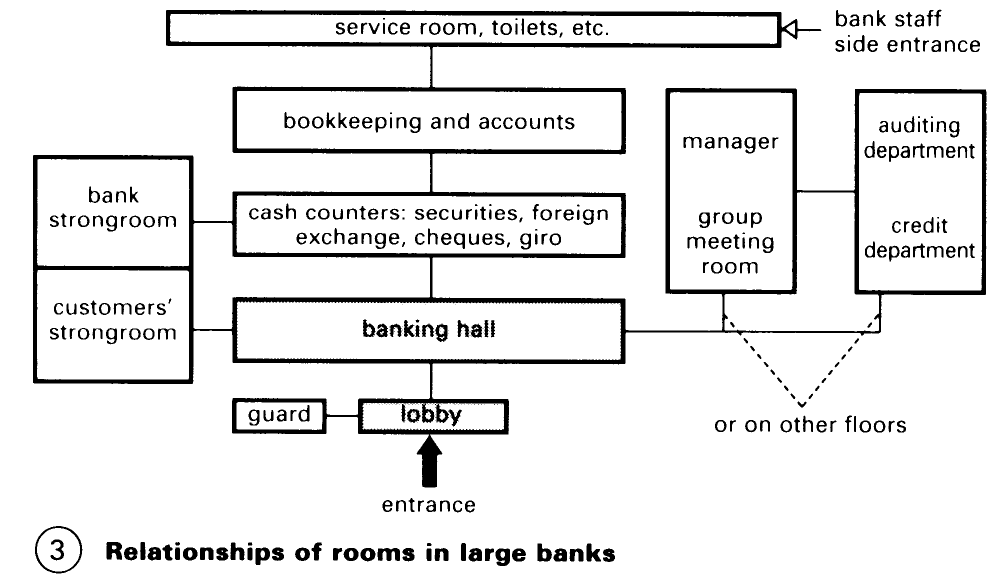

Desks for accounts and bookkeeping staff are usually behind the service counters, where transactions are verified and related operations are dealt with – (1). Cashiers nowadays have individual terminals that display the customers' account details. Other areas serving customers, such as managers' offices, credit and auditing departments, are usually in the rooms leading off the main banking hall, often with separate anterooms, or on an upper floor – (3).

If the bank has safety deposit boxes, access from the banking hall should be via a partition, usually past the securities department and safe custody department, often one flight down, to a protective grille in front of the lobby leading to the strongroom containing the boxes. In smaller banks the strongroom may be divided behind the door into two, one part for bank use the other for customers. Larger banks normally have a separate bank strongroom next to that for customers. Offices of safe custody departments are in front of the entrance to the bank strongroom and have a separate staircase to the banking hall or secure lifts. - (3) Other basement areas must be accessed by a separate staircase. They can provide space for cloakrooms, storage, heating and ventilation plant, communications equipment and so on.

Building societies have existed in the UK since the end of the 18th century. They are societies of investors that accept investments, paying interest on the deposits, and lend to people building or buying properties. The investors are either member-shareholders or simply depositors. They supply the funds from which the house purchase loans are made. The operating basis of an incorporated and permanent Building Society resembles that of a bank so both have similar requirements in terms of building design.

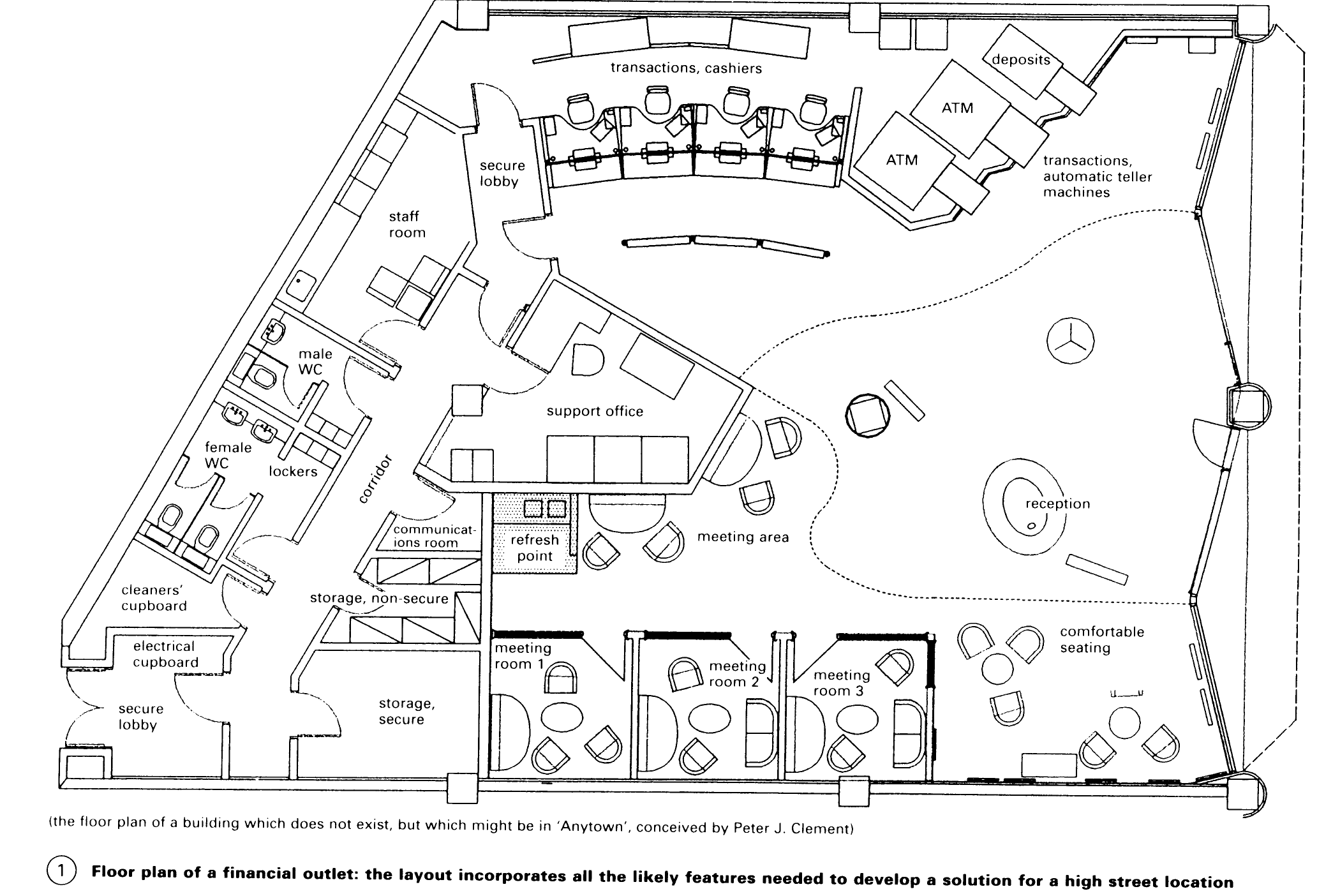

There is a trend towards open-plan layouts in modern banks and building societies. This is intended to provide more room for the customers, making them feel comfortable and welcome. Since bulky protective screens are now almost unnecessary, large additional areas can be opened up for customer use.

Over recent years bank design has evolved to accommodate the following ideals:

- A 'shop-like' retail environment.

- Fully glazed or open frontages to create a more inviting image.

- Services that are dealt with as products to be 'sold' by staff trained to deal with customers in a friendly, attractive environment.

More space given over to the customer and designs with better use of light and colour, prominent merchandising and designated sales, comfortable waiting areas and private interview rooms.

Open-plan principles. The idea of open planning is to bring staff and customers much closer together and build up customer loyalty. The aim is to generate an environment for improved service and with it enhanced business for the bank. Pugh Martin, an architect working with Barclays Bank, listed the following guiding principles relating to a high street open-plan bank:

- Maximise space given over to customer: move service counters as close to perimeter walls as possible; reduce space for support staff and equipment.

- Minimise space for processes and secure areas ('back office' functions are increasingly being moved from branches and centralised).

- Maximise potential for 'selling' financial products: by re-locating counters and non-sales functions, wall and floor space is released for displaying product literature and advertising material. This makes it possible to deliver coordinated marketing campaigns easily seen by the customers.

- Create personal contact space for dealing with financial products: allow for specialised, sometimes purpose-built, self-contained desks at which trained staff can deal face-to-face with customers.

- Achieve an open, inviting and customer-friendly environment that brings the customer in easily, makes each service easy to find and enables the customer to circulate throughout the bank comfortably.

Cash dispensers. Cash dispensers (or automatic teller machines, ATMs) are now a universal feature of modern high street banks and building societies. They can sit inside the bank or face into the street, the latter allowing customers access to their account details and funds 24 hours per day.

Cash dispensers are usually built into the bank fagade and they need to: (1) be at or near ground level to allow for easy public access, (2) allow access from the rear to bank staff, (3) not disrupt window frames, sills or horizontal banding, and (4) correspond to the rhythm and scale of the fenestration above.

Sometimes, cash dispensers are placed at the side of the building, which helps to solve the problems of disabled access and of obstruction of the pavement if queues form at busy times when the bank is closed. In larger banks, a number of cash dispensers can be set in an adjoining lobby that is open to customers at all times.

Date added: 2023-01-05; views: 846;