Industrial Location Decisions. Capital. Government Policy

Regardless of labor costs, the success of any industry depends on the availability of capital. Capital is money used to purchase the necessary machinery, land, and raw materials needed to maintain an industrial enterprise.

Entrepreneurs depend on the availability of capital, which is invested in search of profit. In general, manufacturing attracts investment capital because the very process of transforming natural resources into finished products adds value. Yet capital is not equally available at all locations. Rather, capital tends to be invested in those industries and areas where high profits are anticipated. Meanwhile, investors refrain from sinking capital into risky enterprises. Lack of available capital has often hindered industrial development in impoverished areas.

Capital investment is especially critical to the development of new and innovative production processes. Older and more established firms can create capital through successful production. Profits generated from the sale of previously manufactured goods can be reinvested in order to expand productive capacity. The success of new businesses, however, often depends on venture capital, or capital made available for investment in innovative enterprises.

Throughout history, new industries have often located in regions where venture capital was most readily available. Michigan banks were ready to provide loans to automobile manufacturers long before it was apparent that the manufacture of automobiles would prove to be a highly profitable enterprise. In fact, several early automobile manufacturers, including Henry Ford, were turned down by banks in established industrial centers before finding the necessary funding in Detroit. The availability of capital proved crucial to the development of Detroit as a center for automobile manufacturing and Akron, Ohio, as a center for the manufacture of tires and other rubber products.

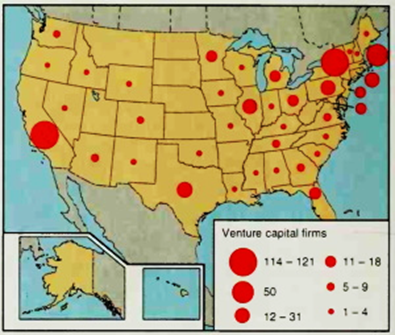

Today, the availability of venture capital is critical to the development of many high-technology firms. Venture capital tends to be concentrated in highly developed areas. In the United States, venture-capital firms are concentrated in California, New York, Massachusetts, and other large industrial states (Figure 8-7). By contrast, venture capital is less abundant in the Great Plains and other less urbanized regions where industry is less prevalent.

Figure 8—7 Venture Capital. Venture capital is critical to the establishment of new industry. In the United States, venture-capital investment is concentrated in economically strong areas, including the East and West coasts

The lack of capital availability has hindered industrial development in many regions, including inner cities and depressed rural areas. In response, some experts have argued that governments should enact policies encouraging capital investment in depressed regions. Such regions would be designated as "enterprise zones," with the federal government providing ready access to the capital needed by entrepreneurs who invested in firms located within them.

Government Policy.The possibility of enterprise zones illustrates the importance of government policy to locational decision making. Some governments provide capital to entrepreneurs directly. The Japanese government invests large amounts of money to develop export-oriented industries, as we will discuss in greater detail in the section on newly industrializing countries. In other countries, favorable conditions for capital accumulation, such as reduced business taxes and provision of land, are provided by governments to support industrial development.

Most governments recognize that the presence of industry provides substantial economic benefits to their constituencies; thus, they compete zealously for new production facilities. Many offer tax breaks and other economic incentives to encourage firms to locate their production facilities within their boundaries. Some maintain economic development offices to solicit new industry. Mass media are used extensively to extol the advantages of the community to new businesses and their employees (Figure 8-8).

Figure 8-8 The Mass Media and Industrial Location. In contemporary society, governments have been increasingly involved in promoting industrial location. Advertising is used extensively in the attempt to draw in new business

More concrete incentives include the provision of land, buildings, housing for workers, and other infrastructure funded by the state or local government. Highways, ports, railroad lines, and airports may be built or expanded to encourage the location of new industry.

Tax breaks and economic incentives may be provided only for a limited time. Once a firm establishes itself in a particular location, it is difficult and expensive for it to move somewhere else. The fact that a corporation invests millions of dollars to build a plant at a given location contributes to its locational inertia. The firm will be reluctant to relocate even if a second location would eventually prove more profitable. Even though more and more American automobiles are sold in Florida, Texas, and California, the immediate cost of relocating the industry from its base in Detroit would be prohibitive.

Date added: 2024-03-15; views: 537;