The Contemporary Geography of International Trade and Investment

Despite the problems associated with the implementation of GATT. international trade continues to increase. By the mid-1980s the volume of international trade had approached two trillion American dollars annually.

In the contemporary international market, each country maintains a distinctive pattern of trade. International trade patterns are explained in part by the basic components of spatial interaction described earlier in this chapter. International trade is dependent on complementarity, transferability, and the absence of intervening opportunity.

Hence, trade increases when supplies produced in one country are in demand in others. The international petroleum market emphasizes trade between the oil-rich countries of Southwest Asia and the oil-deficient industrialized countries of Europe and the Far East (Figure 9-12).

Figure 9-12 International Petroleum Trade. Petroleum is traded between producers and consumers throughout the world. Petroleum from Southwest Asia is consumed in Europe. North America, Japan, and many other countries

As a result of modern global communication and transportation networks, however, contemporary international trade is not as strongly influenced by the absence of transferability and the presence of intervening opportunities as had been the case historically. Absolute distance no longer predicts international trade flows as accurately as in the past.

In many cases, trade patterns are influenced by cultural and linguistic affinity. Thus, many of Britain's major trade partners are fellow English-speaking nations, including its former colonies of Canada, Australia, and the United States. Trade patterns are also influenced by colonial history. The creation of favorable trade balances and markets was an important incentive behind European colonization of the Americas, Africa, and Asia.

European languages achieved lingua franca status in European colonies. Once these colonies achieved political independence, trade patterns that had developed during the colonial period persisted. Even within developed countries like the United States, the location of investment from different countries tends to vary.

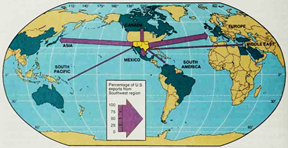

Markets for U.S. exports are also characterized by distinct trade patterns (Figure 9-13a). More than half of all exports from the Great Lakes states (Ohio, Indiana. Illinois. Michigan, and Wisconsin) are shipped northward to Canada. No other country imports more than 5 percent of the goods produced in this region. On the other hand, Mexico dominates exports from the southwestern states (Oklahoma. Texas, New Mexico, and Arizona) (Figure 9-13b).

Not surprisingly, Japan imports more goods from the Pacific states than from other regions in the United States and goods from states on the Atlantic coast are more likely to be exported to Europe than to Asian destinations.

Figure 9-13 American Exports by Region. Regions of the United States differ with respect to international trade patterns. Canada is the primary market for those products manufactured in the Rust Belt (top), whereas firms in the southwestern states are more likely to sell their products in Latin America (bottom)

The geography of international trade is subject to frequent change. Many trade patterns persist over several decades, whereas others change abruptly, often because of political conflict between countries. Except for Soviet grain imports, trade between the United States and the Soviet Union, and indeed between Western and Eastern Europe, was minimal during the cold war period prior to the collapse of Soviet Communism in 1991. As cold war tensions have lessened, trade between Eastern Europe and the West has begun to pick up dramatically.

Many observers regard Western investment as essential to the development of trade between Eastern Europe and the developed countries of Western Europe and North America. Trade with the West is essential to the diffusion of capital and technology to the former Soviet satellites of Eastern Europe. Leaders of newly democratized Poland, Hungary, and Czechoslovakia have pursued Western economic aid aggressively.

Over four hundred agreements between the Western business community and localities in these three countries were reached in late 1990 and early 1991 alone. Western economic investment tended to be concentrated in major cities, such as Warsaw, Prague, and Budapest, and in some of the heavily industrialized districts in the western parts of these countries (Figure 9-14).

Figure 9-14 Trade between the United States and Eastern Europe. During the cold war, the Iron Curtain restricted trade between Eastern Europe and the United States. As cold war tensions lessened and eventually disappeared, trade increased substantially, but U.S. investment is heavily concentrated in political capitals and industrial districts adjacent to Western Europe

Although the Soviets had promoted industrialization in other parts of these countries, including eastern Poland and Hungary, these areas have attracted relatively little Western investment so far. Western capital has favored the western portions of Poland, Hungary, and Czechoslovakia not only because of the proximity of these areas to the West, but also because of historical cultural affinities between these places and Western Europe.

The concentration of foreign investment in these cities will likely establish the political capitals of Eastern Europe as centers of East-West trade in the years ahead.

The possibility of increased trade between East and West has become a matter of concern among leaders of some less developed countries. During the cold war, both the United States and the Soviet Union were eager to befriend potential allies in the Third World. At that time, both superpowers offered favorable terms of trade to less developed countries, which in turn played off the Americans and Soviets against each other.

Today, however, the collapse of Soviet Communism has eliminated this superpower competition. More developed and more accessible markets in Russia and Eastern Europe may attract Western development capital that previously had been invested in the less developed countries. Leaders in some less developed countries fear that they will no longer be able to attract favorable terms of trade with the Europeans and Americans.

Date added: 2024-03-20; views: 590;